A Comprehensive Forex Trading Beginner Guide

Forex trading, often referred to as foreign exchange trading or currency trading, can be a profitable endeavor for individuals willing to invest time and effort. This guide aims to provide beginners with a foundational understanding of the forex market, strategies, risk management, and tools that are available to traders. Whether you’re considering diving into the forex market or wanting to enhance your understanding, this guide covers essential topics to help you on your trading journey. The key is to understand the market’s intricacies and take informed decisions. For enhanced mobility and access to trading tools, consider using a forex trading beginner guide Trading App APK.

What is Forex Trading?

The forex market is the largest financial market in the world, where currencies are traded 24 hours a day, five days a week. It involves buying one currency while simultaneously selling another. The market is decentralized and operates through a global network of banks, brokers, and financial institutions. Forex trading is driven by various factors including economic indicators, geopolitical events, and market sentiment. Beginners should get familiar with the basic concepts of currency pairs, pips, and leverage.

Understanding Currency Pairs

In forex trading, currencies are traded in pairs. Each pair consists of two currencies: the base currency and the quote currency. The base currency is the first currency in the pair, and the quote currency is the second. For example, in the EUR/USD pair, the euro (EUR) is the base currency, and the US dollar (USD) is the quote currency. The exchange rate indicates how much of the quote currency is needed to purchase one unit of the base currency. Understanding which factors affect these exchange rates is crucial for making informed trading decisions.

Major Currency Pairs

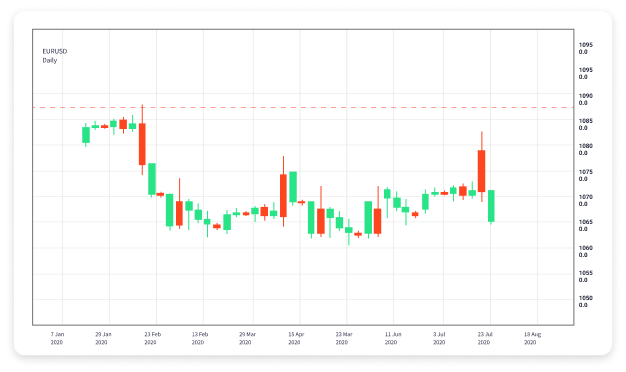

The most commonly traded currency pairs are known as major pairs, which include EUR/USD, USD/JPY, GBP/USD, and USD/CHF. They are characterized by high liquidity and lower spreads compared to other pairs. Beginners should focus on these pairs as they are generally easier to trade due to their predictability and the wealth of information available about these currencies.

Types of Forex Analysis

To navigate the forex market successfully, traders utilize different types of analysis to make informed decisions. The three primary types of analysis include:

- Fundamental Analysis: This involves evaluating economic indicators, geopolitical events, and overall economic conditions that can affect currency values. Traders look at factors such as interest rates, inflation, unemployment rates, and GDP.

- Technical Analysis: Traders use historical price data and chart patterns to predict future price movements. Various technical indicators, like moving averages and oscillators, help in understanding market trends.

- Sentiment Analysis: This approach gauges the mood of the market and analyzes how traders are feeling about certain currencies. Sentiment can often drive price movements in the short term.

Developing a Trading Strategy

A well-defined trading strategy is essential for success in forex trading. This involves setting clear goals, determining the risk tolerance, and deciding on a trading style. Some common trading styles include:

- Scalping: This strategy involves making multiple trades throughout the day to capitalize on small price movements.

- Day Trading: Day traders open and close positions within the same day, avoiding overnight exposure to the market.

- Swing Trading: This style involves holding positions for several days or weeks to capture price swings in the market.

- Position Trading: This long-term strategy involves holding positions for months or even years based on fundamental analysis.

The Importance of Risk Management

One of the most crucial aspects of forex trading is risk management. Without effective risk management strategies, traders may face significant losses. Key elements of risk management include:

- Setting Stop-Loss Orders: Traders should use stop-loss orders to limit potential losses on a trade by automatically closing positions at a predetermined price level.

- Position Sizing: Determining the appropriate position size for each trade based on the total account size and risk tolerance is essential to avoid large losses.

- Diversification: By diversifying trades across various currency pairs, traders can mitigate risks associated with specific currencies.

Choosing a Forex Broker

Selecting a reliable forex broker is one of the most critical steps for newcomers. Factors to consider when choosing a broker include:

- Regulation: Ensure the broker is regulated by reputable authorities to guarantee the safety of funds.

- Trading Platform: A user-friendly and feature-rich trading platform enhances the trading experience.

- Spreads and Commissions: Compare costs associated with trading, including spreads and any commissions charged.

- Customer Support: Efficient customer support can be invaluable for resolving issues that may arise during trading.

Using Demo Accounts

For beginners, using a demo account is a great way to practice trading without risking real money. Most brokers offer demo accounts, allowing traders to familiarize themselves with the trading platform, test strategies, and develop their skills in a risk-free environment. A demo account simulates the live market and helps traders gain confidence before transitioning to a live trading account.

Continuously Learning and Improving

The forex market is constantly evolving, and staying updated with market trends and news is vital. Continuous learning through webinars, online courses, and books can enhance your trading knowledge. Additionally, analyzing past trades helps identify areas for improvement and refine trading strategies.

Conclusion

Forex trading can be a rewarding venture for those who approach it with the right mindset and preparation. This beginner guide covers the essential aspects of forex trading, from understanding currency pairs and analysis types to developing a sound trading strategy and risk management. New traders should remember the importance of continuous learning and adaptation in this fast-paced market. With practice and perseverance, success in forex trading is an achievable goal. Start your trading journey today, and who knows, you might become a successful trader in the forex market!