Understanding Pips in Forex Trading: A Comprehensive Guide

In the world of forex trading, understanding the concept of pips is crucial for both novice and experienced traders. A pip, which stands for “percentage in point”, is a unit of measurement that represents the smallest price movement in a currency pair. This article will elucidate what pips are, how they work, and why they are important in forex trading. Additionally, we will discuss how to calculate them and provide some valuable tips to maximize your trading strategies. For those interested in enhancing their trading experience, check out the forex trading pip Best Crypto Apps to stay ahead in the market.

What is a Pip?

A pip is typically the fourth decimal place in most currency pairs. For example, if the EUR/USD pair moves from 1.1050 to 1.1051, that 0.0001 USD rise in value represents one pip. In pairs involving the Japanese Yen, however, a pip is the second decimal place (e.g., a move from 110.50 to 110.51). Understanding how pips work is essential because they are used to quantify price movements and assess market volatility.

The Importance of Pips in Forex Trading

Pips are vital in forex trading as they determine the profit or loss from trading activities. Since currency values fluctuate constantly, measuring profits and losses in pips helps traders gauge their performance. For instance, if a trader buys the EUR/USD pair at 1.1050 and sells it at 1.1060, they have made a profit of 10 pips. Knowing how to analyze and react to pip movements is crucial for developing effective trading strategies.

How to Calculate Pips

Calculating pips is relatively straightforward. The formula generally involves taking the difference between the opening and closing prices of a trade and expressing that difference in pips. Here’s a simple example:

- Assume you buy a currency pair at 1.1500 and sell it at 1.1525.

- The difference in price is 1.1525 – 1.1500 = 0.0025.

- Since EUR/USD is measured in four decimal places, you convert 0.0025 to pips, which equals 25 pips.

For currency pairs involving the Japanese Yen, the process is similar but focused on the two decimal places.

How Pips Affect Forex Trading Decisions

Traders often use pip calculations to make informed trading decisions. For instance, when setting stop-loss and take-profit orders, understanding how many pips you are willing to risk is vital. If a trader has a tight stop-loss of 10 pips, they must be confident in their analysis to ensure the price doesn’t move against them significantly. Additionally, leveraging high pip movements can significantly influence a trader’s risk-reward ratio.

Understanding Lot Size and Its Impact on Pips

The concept of lot size is closely tied to pips in forex trading. A lot represents the minimum quantity of currency units you can trade. Traditionally, one standard lot equals 100,000 units, meaning every pip move typically equates to a profit or loss of $10 (for standard lots). Similarly, for a mini lot (10,000 units), each pip is worth $1. Understanding lot sizes helps traders manage their exposure based on the amount of risk they are willing to take on in pips.

Maximizing Trading Strategies with Pip Analysis

Incorporating pip analysis into your trading strategy can increase your overall profitability. Here are some tips:

- Keep Track of Economic Indicators: Economic events can lead to significant pip movements. Monitoring news related to economic indicators such as interest rates, employment figures, and GDP can help you anticipate price movements.

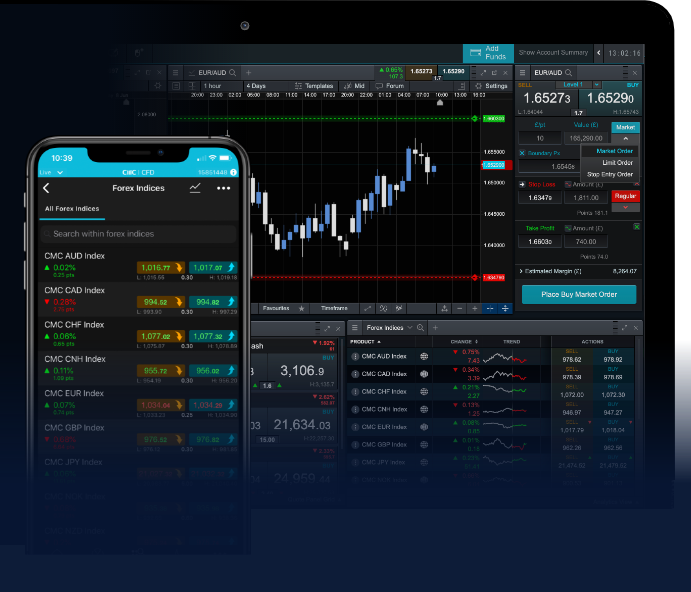

- Use Technical Analysis: Utilize charts and indicators to determine potential entry and exit points based on historical pip movements.

- Set Realistic Targets: Knowing how many pips you can realistically expect to gain can help in setting achievable targets without being overly ambitious.

- Implement Risk Management: Use pip-based risk management techniques, such as the R:R (risk-to-reward) ratio, to structure your trades effectively.

Common Pitfalls to Avoid with Pips

When trading forex, it’s essential to avoid common pitfalls associated with understanding pips:

- Neglecting Spreads: Always factor in the spread (the difference between the buy and sell price) when calculating your potential gains or losses in pips.

- Overtrading: High pip counts can attract traders to overtrade, causing them to lose focus and discipline. Stick to your trading plan!

- Ignoring Market Conditions: Market conditions can greatly influence pip movements. Ignoring trends or consolidations can be detrimental to your trading strategy.

Conclusion

Understanding pips is essential for successful forex trading. They allow traders to quantify their gains and losses, manage risk, and structure their trades strategically. By mastering pip calculations and leveraging this knowledge in your trading strategies, you can improve your trading performance and work towards becoming a more proficient trader. Remember to combine pip analysis with other tools like technical analysis and economic indicators to effectively navigate the dynamic world of forex.